Rich motherf**kers avoiding tax

- caldeyrfc

- Posts: 118

- Joined: Wed Feb 10, 2016 5:39 pm

Re: Rich motherf**kers avoiding tax

I know that there is some debate about the accuracy of the stats but there was a question in The House yesterday saying that there are 3700 people looking into benefit fraud and 300 people looking into tax fraud to those earning more than £150k pa

Gatland apologist

- Donny osmond

- Posts: 3209

- Joined: Tue Feb 09, 2016 5:58 pm

Re: RE: Re: Rich motherf**kers avoiding tax

"Some debate" would appear to mean its utter horsesh1t... At least according to this link...caldeyrfc wrote:I know that there is some debate about the accuracy of the stats but there was a question in The House yesterday saying that there are 3700 people looking into benefit fraud and 300 people looking into tax fraud to those earning more than £150k pa

http://www.politics.co.uk/blogs/2016/04 ... ny-fraud-i

Sent from my XT1052 using Tapatalk

It was so much easier to blame Them. It was bleakly depressing to think They were Us. I've certainly never thought of myself as one of Them. No one ever thinks of themselves as one of Them. We're always one of Us. It's Them that do the bad things.

- canta_brian

- Posts: 1262

- Joined: Tue Feb 09, 2016 9:52 pm

Re: RE: Re: RE: Re: Rich motherf**kers avoiding tax

Although...Donny osmond wrote:"Some debate" would appear to mean its utter horsesh1t... At least according to this link...caldeyrfc wrote:I know that there is some debate about the accuracy of the stats but there was a question in The House yesterday saying that there are 3700 people looking into benefit fraud and 300 people looking into tax fraud to those earning more than £150k pa

http://www.politics.co.uk/blogs/2016/04 ... ny-fraud-i

Sent from my XT1052 using Tapatalk

http://www.politics.co.uk/blogs/2016/04 ... ny-fraud-i

The link in the first comment and subsequent discussion does seem to highlight the issues.

https://www.gov.uk/government/news/hmrc ... inspectors

Recruited to join a team of just 200 - meaning 300 in total I guess. The team looks at the super rich apparently.

- Mellsblue

- Posts: 14541

- Joined: Thu Feb 11, 2016 7:58 am

Re: RE: Re: RE: Re: Rich motherf**kers avoiding tax

So, let's assume the 300 and 3,700 figures are correct - they won't be, as with both sides, they'll be conveniently massaged. ONS figures have 2.485 million people claiming out of work benefits whilst the Global Wealth Report have 5,400 super rich in the UK.canta_brian wrote:Although...Donny osmond wrote:"Some debate" would appear to mean its utter horsesh1t... At least according to this link...caldeyrfc wrote:I know that there is some debate about the accuracy of the stats but there was a question in The House yesterday saying that there are 3700 people looking into benefit fraud and 300 people looking into tax fraud to those earning more than £150k pa

http://www.politics.co.uk/blogs/2016/04 ... ny-fraud-i

Sent from my XT1052 using Tapatalk

http://www.politics.co.uk/blogs/2016/04 ... ny-fraud-i

The link in the first comment and subsequent discussion does seem to highlight the issues.

https://www.gov.uk/government/news/hmrc ... inspectors

Recruited to join a team of just 200 - meaning 300 in total I guess. The team looks at the super rich apparently.

Do the maths......

- Donny osmond

- Posts: 3209

- Joined: Tue Feb 09, 2016 5:58 pm

Re: RE: Re: RE: Re: RE: Re: Rich motherf**kers avoiding tax

I love maths!!!Mellsblue wrote:So, let's assume the 300 and 3,700 figures are correct - they won't be, as with both sides, they'll be conveniently massaged. ONS figures have 2.485 million people claiming out of work benefits whilst the Global Wealth Report have 5,400 super rich in the UK.canta_brian wrote:Although...Donny osmond wrote: "Some debate" would appear to mean its utter horsesh1t... At least according to this link...

http://www.politics.co.uk/blogs/2016/04 ... ny-fraud-i

Sent from my XT1052 using Tapatalk

http://www.politics.co.uk/blogs/2016/04 ... ny-fraud-i

The link in the first comment and subsequent discussion does seem to highlight the issues.

https://www.gov.uk/government/news/hmrc ... inspectors

Recruited to join a team of just 200 - meaning 300 in total I guess. The team looks at the super rich apparently.

Do the maths......

2.458mill ÷ 3700 is 671 benefiters being checked by each cheat-seeker

5400 ÷ 300 is 18 dodgers being checked by each dodger-seeker.

Hence there is far more emphasis on finding super rich tax dodgers than on catching benefit cheats.

Did I do the right maths?

Sent from my XT1052 using Tapatalk

It was so much easier to blame Them. It was bleakly depressing to think They were Us. I've certainly never thought of myself as one of Them. No one ever thinks of themselves as one of Them. We're always one of Us. It's Them that do the bad things.

- Mellsblue

- Posts: 14541

- Joined: Thu Feb 11, 2016 7:58 am

Re: RE: Re: RE: Re: RE: Re: Rich motherf**kers avoiding tax

Why, Donny. I think you may be correct.Donny osmond wrote:I love maths!!!Mellsblue wrote:So, let's assume the 300 and 3,700 figures are correct - they won't be, as with both sides, they'll be conveniently massaged. ONS figures have 2.485 million people claiming out of work benefits whilst the Global Wealth Report have 5,400 super rich in the UK.canta_brian wrote: Although...

http://www.politics.co.uk/blogs/2016/04 ... ny-fraud-i

The link in the first comment and subsequent discussion does seem to highlight the issues.

https://www.gov.uk/government/news/hmrc ... inspectors

Recruited to join a team of just 200 - meaning 300 in total I guess. The team looks at the super rich apparently.

Do the maths......

2.458mill ÷ 3700 is 671 benefiters being checked by each cheat-seeker

5400 ÷ 300 is 18 dodgers being checked by each dodger-seeker.

Hence there is far more emphasis on finding super rich tax dodgers than on catching benefit cheats.

Did I do the right maths?

Sent from my XT1052 using Tapatalk

- caldeyrfc

- Posts: 118

- Joined: Wed Feb 10, 2016 5:39 pm

Re: Rich motherf**kers avoiding tax

So more effort is put into catching Dai the Dole trousering £15 for doing some OAP's lawn than catching multi millionaires squirreling untold amounts in off shore tax havens.

What a crazy fvcked up world we live in

What a crazy fvcked up world we live in

Gatland apologist

- canta_brian

- Posts: 1262

- Joined: Tue Feb 09, 2016 9:52 pm

Re: Rich motherf**kers avoiding tax

Apparently it takes the same time to persue and prosecute a benefit cheat as it does a person employing expensive lawyers and accountants specifically to ensure they avoid detection.

Although it could be that your maths proves absolutely nothing in this case.

Although it could be that your maths proves absolutely nothing in this case.

- Mellsblue

- Posts: 14541

- Joined: Thu Feb 11, 2016 7:58 am

Re: Rich motherf**kers avoiding tax

At least it is maths. Rather than just saying two numbers with absolutely no context whatsoever.canta_brian wrote:Apparently it takes the same time to persue and prosecute a benefit cheat as it does a person employing expensive lawyers and accountants specifically to ensure they avoid detection.

Although it could be that your maths proves absolutely nothing in this case.

- morepork

- Posts: 7517

- Joined: Wed Feb 10, 2016 1:50 pm

Re: Rich motherf**kers avoiding tax

I like the way they cut benefits for disabled people while simultaneously caving in to lobbyists for tax legislation that promotes legal "avoidance".

- canta_brian

- Posts: 1262

- Joined: Tue Feb 09, 2016 9:52 pm

Re: Rich motherf**kers avoiding tax

Actually it's worse. Your maths was designed to give credence to an entirely false point.

- Mellsblue

- Posts: 14541

- Joined: Thu Feb 11, 2016 7:58 am

Re: Rich motherf**kers avoiding tax

It's not 'entirely false' just because you don't believe the underlying premise it to be true. Facts are that there are vastly more employees chasing fraud per 'super rich' than per 'out of work' claimant. This might not fit your narrative and it might not be how you would choose categorise it, but it is fact.canta_brian wrote:Actually it's worse. Your maths was designed to give credence to an entirely false point.

You might like to find some reputable figures and work out hours worked per pound recovered or something similar, and if you do and it proves that more man power is spent on benefit fraud than tax avoidance per pound recovered then I'll happily except it and, if it's heavily skewed, think the government is wrong. I won't just refuse to accept it and call your viewpoint 'entirely false'.

- Len

- Posts: 608

- Joined: Fri Feb 12, 2016 1:04 pm

Re: Rich motherf**kers avoiding tax

Head on pikes mate. Head on pikes.caldeyrfc wrote:So more effort is put into catching Dai the Dole trousering £15 for doing some OAP's lawn than catching multi millionaires squirreling untold amounts in off shore tax havens.

What a crazy fvcked up world we live in

- Stom

- Posts: 5828

- Joined: Wed Feb 10, 2016 10:57 am

Re: Rich motherf**kers avoiding tax

It's like the way my parents were so against Labour because they wanted to reduce - or rather, not put up - the inheritance tax threshold. They believed their dead bodies would be taxed to hell and back, when in reality, they are not liable.morepork wrote:I like the way they cut benefits for disabled people while simultaneously caving in to lobbyists for tax legislation that promotes legal "avoidance".

That's the disgusting thing, that the media completely lies about things like this. We could destroy a good proportion of the Tory vote simply by telling the truth.

-

UGagain

- Posts: 809

- Joined: Wed Feb 17, 2016 7:39 am

Re: Rich motherf**kers avoiding tax

As for the maths. There are mathematic 'theories' on both sides, they are not the same as mathematical facts. I asked for maths.

Mellsblue.

Mellsblue.

-

jared_7

- Posts: 612

- Joined: Wed Feb 17, 2016 4:47 pm

Re: RE: Re: RE: Re: RE: Re: Rich motherf**kers avoiding tax

Are we seriously saying there are only 5400 people "rich enough" in the whole of the U.K. to dodge tax through offshore accounts and other questionable tactics?Mellsblue wrote:Why, Donny. I think you may be correct.Donny osmond wrote:I love maths!!!Mellsblue wrote:

So, let's assume the 300 and 3,700 figures are correct - they won't be, as with both sides, they'll be conveniently massaged. ONS figures have 2.485 million people claiming out of work benefits whilst the Global Wealth Report have 5,400 super rich in the UK.

Do the maths......

2.458mill ÷ 3700 is 671 benefiters being checked by each cheat-seeker

5400 ÷ 300 is 18 dodgers being checked by each dodger-seeker.

Hence there is far more emphasis on finding super rich tax dodgers than on catching benefit cheats.

Did I do the right maths?

Sent from my XT1052 using Tapatalk

That's 0.008% of the population. How many are looking at the rest of the top 0.1%, which would be another 66,000 people approximately with an average income of £1m a year and who knows what other assets? The top 1%, another 600,000 people, make over £260,000 in income per year and will pretty much all employ accountants.

Your argument is false, purely through lack of accurate figures. We have the number of people looking after the total number of benefit clamants and a number of people looking after a tiny, minuscule percentage of the people who may actually dodge tax. If there is no one assigned to look at the rest, then they are hugely understaffed.

- Eugene Wrayburn

- Posts: 2307

- Joined: Tue Feb 09, 2016 8:32 pm

Re: RE: Re: RE: Re: RE: Re: Rich motherf**kers avoiding tax

There are 26000 employees of HMRC. They are pretty much all there to stop people evading tax. That's what makes the SNP's point absurd, but you clung onto that. Mells point is that even on Angus Robertson's own terms, he was talking rubbish, yet you lapped it up as truth from on high without complaint.jared_7 wrote:Are we seriously saying there are only 5400 people "rich enough" in the whole of the U.K. to dodge tax through offshore accounts and other questionable tactics?Mellsblue wrote:Why, Donny. I think you may be correct.Donny osmond wrote: I love maths!!!

2.458mill ÷ 3700 is 671 benefiters being checked by each cheat-seeker

5400 ÷ 300 is 18 dodgers being checked by each dodger-seeker.

Hence there is far more emphasis on finding super rich tax dodgers than on catching benefit cheats.

Did I do the right maths?

Sent from my XT1052 using Tapatalk

That's 0.008% of the population. How many are looking at the rest of the top 0.1%, which would be another 66,000 people approximately with an average income of £1m a year and who knows what other assets? The top 1%, another 600,000 people, make over £260,000 in income per year and will pretty much all employ accountants.

Your argument is false, purely through lack of accurate figures. We have the number of people looking after the total number of benefit clamants and a number of people looking after a tiny, minuscule percentage of the people who may actually dodge tax. If there is no one assigned to look at the rest, then they are hugely understaffed.

I refuse to have a battle of wits with an unarmed person.

NS. Gone but not forgotten.

NS. Gone but not forgotten.

-

jared_7

- Posts: 612

- Joined: Wed Feb 17, 2016 4:47 pm

Re: RE: Re: RE: Re: RE: Re: Rich motherf**kers avoiding tax

I didn't lap up anything.Eugene Wrayburn wrote:There are 26000 employees of HMRC. They are pretty much all there to stop people evading tax. That's what makes the SNP's point absurd, but you clung onto that. Mells point is that even on Angus Robertson's own terms, he was talking rubbish, yet you lapped it up as truth from on high without complaint.jared_7 wrote:Are we seriously saying there are only 5400 people "rich enough" in the whole of the U.K. to dodge tax through offshore accounts and other questionable tactics?Mellsblue wrote:

Why, Donny. I think you may be correct.

That's 0.008% of the population. How many are looking at the rest of the top 0.1%, which would be another 66,000 people approximately with an average income of £1m a year and who knows what other assets? The top 1%, another 600,000 people, make over £260,000 in income per year and will pretty much all employ accountants.

Your argument is false, purely through lack of accurate figures. We have the number of people looking after the total number of benefit clamants and a number of people looking after a tiny, minuscule percentage of the people who may actually dodge tax. If there is no one assigned to look at the rest, then they are hugely understaffed.

I said her little maths experiment to prove a point was false "purely through lack of accurate figures". That applies to Cantab's argument as well.

I do, however, believe that benefit fraud is focussed on too much in society in relation to the very wealthy avoiding doing their bit. Of course this may not be HMRC's fault and I don't have evidence to suggest they are neglecting this area, all I have is 30 years of mass wealth redistribution to the top 1% at a rate that is continuing to increase and a massive leak of documents suggesting it is a huge issue that needs to be addressed.

Cantab's derision may be misplaced, but I understand misplaced anger, it brings about change, a lot more than I understand you, at almost every step, trying to defend what is going on here.

- Donny osmond

- Posts: 3209

- Joined: Tue Feb 09, 2016 5:58 pm

Re: RE: Re: RE: Re: RE: Re: RE: Re: Rich motherf**kers avoiding tax

No, we're not saying that at all. It hasn't even been intimated.Are we seriously saying there are only 5400 people "rich enough" in the whole of the U.K. to dodge tax through offshore accounts and other questionable tactics?

As stated, there's 300 strong team looking at the 5400 super rich. It hasn't been stated how big the teams are that look at the rest of the the top 0.1% or 1% of any other arbitrary grouping.That's 0.008% of the population. How many are looking at the rest of the top 0.1%, which would be another 66,000 people approximately with an average income of £1m a year and who knows what other assets? The top 1%, another 600,000 people, make over £260,000 in income per year and will pretty much all employ accountants.

But there clearly are people assigned to look at the rest. As stated there are 10s of thousands of people working for hmrc, checking tax receipts. Take away the ones that we know about and there are still 10s of thousands of hmrc employees to be considered.Your argument is false, purely through lack of accurate figures. We have the number of people looking after the total number of benefit clamants and a number of people looking after a tiny, minuscule percentage of the people who may actually dodge tax. If there is no one assigned to look at the rest, then they are hugely understaffed.

Sent from my XT1052 using Tapatalk

It was so much easier to blame Them. It was bleakly depressing to think They were Us. I've certainly never thought of myself as one of Them. No one ever thinks of themselves as one of Them. We're always one of Us. It's Them that do the bad things.

-

jared_7

- Posts: 612

- Joined: Wed Feb 17, 2016 4:47 pm

Re: RE: Re: RE: Re: RE: Re: RE: Re: Rich motherf**kers avoiding tax

Well, evidently, there may be thousands more, but its clearly not enough.Donny osmond wrote:No, we're not saying that at all. It hasn't even been intimated.Are we seriously saying there are only 5400 people "rich enough" in the whole of the U.K. to dodge tax through offshore accounts and other questionable tactics?

As stated, there's 300 strong team looking at the 5400 super rich. It hasn't been stated how big the teams are that look at the rest of the the top 0.1% or 1% of any other arbitrary grouping.That's 0.008% of the population. How many are looking at the rest of the top 0.1%, which would be another 66,000 people approximately with an average income of £1m a year and who knows what other assets? The top 1%, another 600,000 people, make over £260,000 in income per year and will pretty much all employ accountants.

But there clearly are people assigned to look at the rest. As stated there are 10s of thousands of people working for hmrc, checking tax receipts. Take away the ones that we know about and there are still 10s of thousands of hmrc employees to be considered.Your argument is false, purely through lack of accurate figures. We have the number of people looking after the total number of benefit clamants and a number of people looking after a tiny, minuscule percentage of the people who may actually dodge tax. If there is no one assigned to look at the rest, then they are hugely understaffed.

Sent from my XT1052 using Tapatalk

http://www.taxresearch.org.uk/Blog/2014 ... nd-rising/

"Most worrying is the key finding of the report, which is that tax evasion is now likely to amount to £82.1 billion a year, and is rising"

"The figure for tax avoidance estimated in the report is at £19.1bn for 2013/14"

So thats around £100bn avoided or evaded in tax. For reference, benefit fraud is about £1.6bn a year, or 1.5% of the tax figure. Now I know that HMRC is probably having its costs tightened and it probably can't expand its workforce, but with 26,000 people working for them I think 14% of their total staff focussing on an area that accounts for 1.5% of another, much larger area, seems inefficient. Don't you?

- Donny osmond

- Posts: 3209

- Joined: Tue Feb 09, 2016 5:58 pm

Re: RE: Re: RE: Re: RE: Re: RE: Re: RE: Re: Rich motherf**kers avoiding tax

Absolutely I do, and isn't it nice to have some actual figures to discuss instead of bandying around assumptions?jared_7 wrote:Well, evidently, there may be thousands more, but its clearly not enough.Donny osmond wrote:No, we're not saying that at all. It hasn't even been intimated.Are we seriously saying there are only 5400 people "rich enough" in the whole of the U.K. to dodge tax through offshore accounts and other questionable tactics?

As stated, there's 300 strong team looking at the 5400 super rich. It hasn't been stated how big the teams are that look at the rest of the the top 0.1% or 1% of any other arbitrary grouping.That's 0.008% of the population. How many are looking at the rest of the top 0.1%, which would be another 66,000 people approximately with an average income of £1m a year and who knows what other assets? The top 1%, another 600,000 people, make over £260,000 in income per year and will pretty much all employ accountants.

But there clearly are people assigned to look at the rest. As stated there are 10s of thousands of people working for hmrc, checking tax receipts. Take away the ones that we know about and there are still 10s of thousands of hmrc employees to be considered.Your argument is false, purely through lack of accurate figures. We have the number of people looking after the total number of benefit clamants and a number of people looking after a tiny, minuscule percentage of the people who may actually dodge tax. If there is no one assigned to look at the rest, then they are hugely understaffed.

Sent from my XT1052 using Tapatalk

http://www.taxresearch.org.uk/Blog/2014 ... nd-rising/

"Most worrying is the key finding of the report, which is that tax evasion is now likely to amount to £82.1 billion a year, and is rising"

"The figure for tax avoidance estimated in the report is at £19.1bn for 2013/14"

So thats around £100bn avoided or evaded in tax. For reference, benefit fraud is about £1.6bn a year, or 1.5% of the tax figure. Now I know that HMRC is probably having its costs tightened and it probably can't expand its workforce, but with 26,000 people working for them I think 14% of their total staff focussing on an area that accounts for 1.5% of another, much larger area, seems inefficient. Don't you?

Sent from my XT1052 using Tapatalk

It was so much easier to blame Them. It was bleakly depressing to think They were Us. I've certainly never thought of myself as one of Them. No one ever thinks of themselves as one of Them. We're always one of Us. It's Them that do the bad things.

-

UGagain

- Posts: 809

- Joined: Wed Feb 17, 2016 7:39 am

Re: Rich motherf**kers avoiding tax

Benefit fraud is actually good for the economy as the money would tend to be spent. These wealthy tax evaders are by definition savers, so there is negligible benefit.

As for the maths. There are mathematic 'theories' on both sides, they are not the same as mathematical facts. I asked for maths.

Mellsblue.

Mellsblue.

- Eugene Wrayburn

- Posts: 2307

- Joined: Tue Feb 09, 2016 8:32 pm

Re: RE: Re: RE: Re: RE: Re: RE: Re: RE: Re: Rich motherf**kers avoiding tax

Yes, although it would be better if the estimates (and we are only talking estimates here) were rather better used. The vast majority of loss from quoted from "tax research" is trading in the shadow economy or criminal enterprise that doesn't attract tax. Maybe we should send more HMRC people off to make sure VAT is properly charged on drugs...Donny osmond wrote:Absolutely I do, and isn't it nice to have some actual figures to discuss instead of bandying around assumptions?

Sent from my XT1052 using Tapatalk

I refuse to have a battle of wits with an unarmed person.

NS. Gone but not forgotten.

NS. Gone but not forgotten.

- Eugene Wrayburn

- Posts: 2307

- Joined: Tue Feb 09, 2016 8:32 pm

Re: Rich motherf**kers avoiding tax

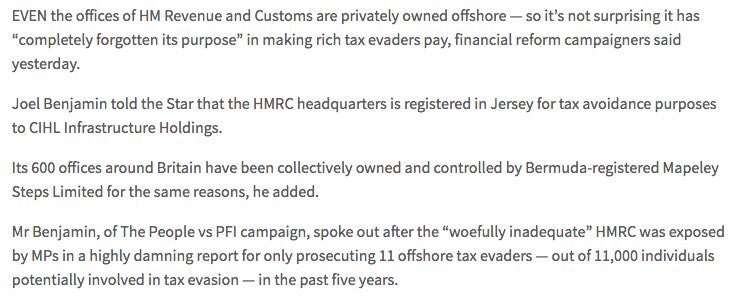

Here's the "Tax Research" table. It seems extremely unlikely to me that there's £6.6 billion of estates tax out there being avoided.

You do not have the required permissions to view the files attached to this post.

I refuse to have a battle of wits with an unarmed person.

NS. Gone but not forgotten.

NS. Gone but not forgotten.

- Mellsblue

- Posts: 14541

- Joined: Thu Feb 11, 2016 7:58 am

Re: Rich motherf**kers avoiding tax

Have a look at who funds Tax Research and for who they have undertaken work.........Eugene Wrayburn wrote:Here's the "Tax Research" table. It seems extremely unlikely to me that there's £6.6 billion of estates tax out there being avoided.